Principles Of Accounting

Organisation of Qualifications & Awards

The main aim of this unit is to introduce learners to the critical accounting concepts which will enable them to appreciate the financial implications of management decisions. Learners will also be introduced to financial methods and critical techniques that will enable them to evaluate the overall effectiveness of companies’ operations.

Upon successful completion of the course students will be able to:

Learning and teaching methods/strategies used to enable the achievement of learning outcomes:

Learning takes place on a number of levels through lectures, class discussion including problem review and analysis. Formal lectures provide a foundation of information on which the student builds through directed learning and self managed learning outside of the class. The students are actively encouraged to form study groups to discuss course material which fosters a greater depth learning experience.

Relevant experience is taken into consideration for students 21 years of age and over who have not completed any formal qualifications.

Introduction to Accounting. The framework. The Accounting equation. Double entry system. The ledgers. Balancing off accounts and the trial balance. Extracting a profit and loss account and a balance sheet of a sole trader from a trial balance. Additional consideration in final accounts. Returns in and out. Accruals and pre-payment. Accounting entries for depreciation of assets. Bad debts and provision for bad debts. Accounting concepts and standards.

The proprietary theory for partnerships. The appropriation of net profit. Formal requirements for company status. Types of shares. Share capital transactions. Loan capital. Profit and loss account and the balance sheet of a company. The disclosure of accounting information.

Concepts of working capital. Control of debts. Allowances for bad debts. The control of creditors. Stock Control. Valuation of stock. Selecting the method of valuation. Funds flow analysis: the nature of funds flows, measuring funds flows, preparing sources and applications of funds statements.

Introduction to Cost Accounting. Break-even analysis. Break-even and profit charts. The role of Cost accounting in profit planning and management decision-making. Concept of contribution. Cost analysis for short-term tactical decisions. Budgeting for profitability. The budgeting process.

Accounting for Non-Accounting Students J. Dyson 7th edition FT Prentice Hall

Accounting Principles J. Weygardt 12th edition (Wiley)

(10 HOURS PER CREDIT)

Tutorial support includes feedback on assignments and may vary by college according to local needs and wishes.

Advance reading and preparation / Class preparation / Background reading / Group study / Portfolio / Diary etc

Working through the course text and completing assignments as required will take up the bulk of the learning time. In addition students are expected to engage with the tutor and other students and to undertake further reading using the web and/or libraries.

Final Examination: 70%

Coursework: 30%

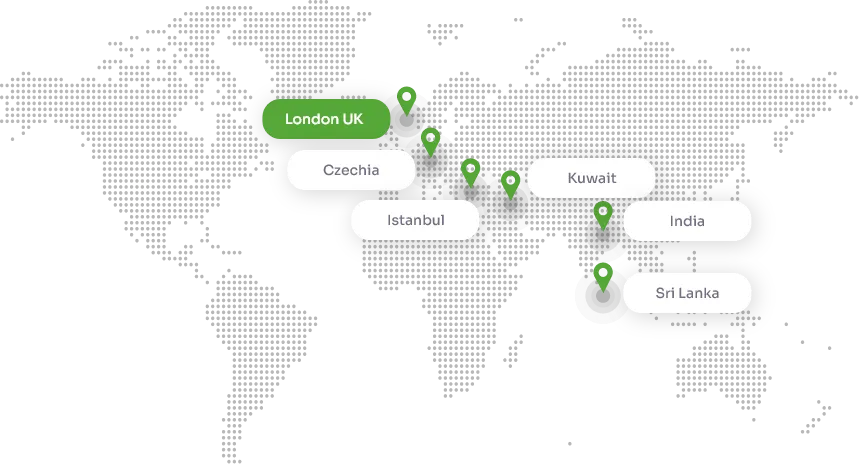

OQA has approved study centres worldwide. Select the your country to see available centres in that area.

3rd Floor, 2-4 Commercial Street, London E1 6LP

2-4, Commercial Street, 3rd Floor London, England, E1 6LP

Hamilton House, 4 Mabledon Pl London WC1H 9BB

160 Jhumat House, London Road IG11 8BB

Its FREE and can be unsubscribed anytime