International Trade And Finance

Organisation of Qualifications & Awards

The main aim of this unit is to provide learners a clear understanding of the different type of risks associated with international trade and transport. It will also highlight the main methods of payment and financial options available to trade and transport organisations.

Upon successful completion of the course students will be able to:

Learning and teaching methods/strategies used to enable the achievement of learning outcomes:

Learning takes place on a number of levels through lectures, class discussion including problem review and analysis. Formal lectures provide a foundation of information on which the student builds through directed learning and self managed learning outside of the class. The students are actively encouraged to form study groups to discuss course material which fosters a greater depth learning experience.

Relevant experience is taken into consideration for students 21 years of age and over who have not completed any formal qualifications.

Handbook of International Trade and Finance A. Grath (Kogan Page)

International Trade Finance P.Cowdell, D’ Hyde (Financial World Press)

Tutorial support includes feedback on assignments and may vary by college according to local needs and wishes.

Advance reading and preparation / Class preparation / Background reading / Group study / Portfolio / Diary etc

Working through the course text and completing assignments as required will take up the bulk of the learning time. In addition students are expected to engage with the tutor and other students and to undertake further reading using the web and/or libraries.

Final Examination: 70%

Coursework: 30%

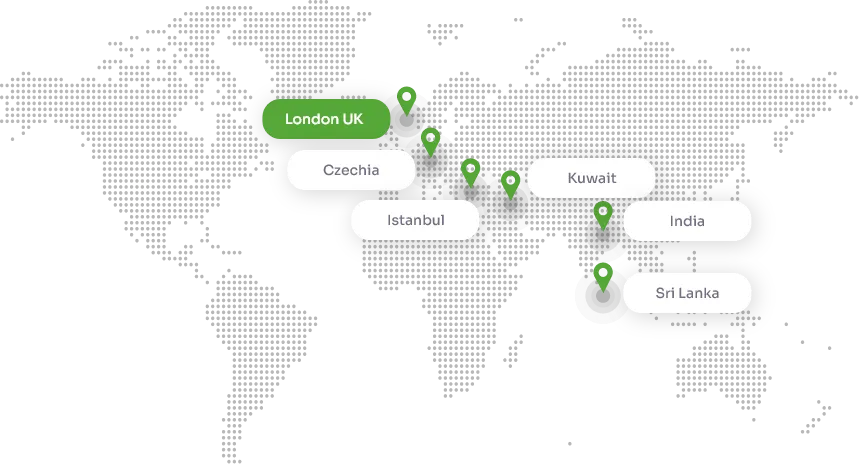

OQA has approved study centres worldwide. Select the your country to see available centres in that area.

3rd Floor, 2-4 Commercial Street, London E1 6LP

2-4, Commercial Street, 3rd Floor London, England, E1 6LP

Hamilton House, 4 Mabledon Pl London WC1H 9BB

160 Jhumat House, London Road IG11 8BB

Its FREE and can be unsubscribed anytime