financial management

| Unit title: |

Financial Management |

| Unit code: |

|

| Level: |

Postgraduate Diploma – Level 7 |

| Credits: |

30 |

main aims of the unit

The main aims of this unit is to develop the knowledge and skills required by the learners in the interpretation and analysis of financial statement to improve the quality and accuracy of the decision making process.

The unit provides an understanding of how the value of businesses can be determined in financial statement and how this information can be assessed in the company’s operating environments

The unit also concentrates on accounting concepts, principles and techniques in relation to financial statements analysis and explores management accounting techniques of value to corporate decision-making

The unit will enable students to:

- Identify, explain, justify and evaluate the financial techniques used in internal and external financial reporting:

- Interpret accounting statements and reports

- Apply the information for decision making

- Provide an understanding of economic tools and their applications to financial data.

- Develop knowledge and critical understanding of the theoretical models, analytical methods and practical aspects of corporate financial decision making

- Identify a company’s financial strategy and explain the implications to the company’s operations, development and long term sustainability

main topics of study

the financial world

- Corporate Governance.

- Role of financial manager

- Flow of funds and financial intermediaries

- Growth in the financial services sector

- The financial system

the investment decision and project appraisal

- Value creation and corporate investment

- Net present value and internal rate of return

- Estimating project viability

- The replacement decision and the replacement cycles

- Annual equivalent annuity method

- Timing of projects

- Make or buy decisions

- Fluctuating output

decision-making process for investment appraisal

- Appraisal techniques

- Payback and accounting rate of return

- The investment process

- Capital rationing

- Taxation and investment appraisal

- Inflation

risk and return

- Assessment of risk

- Adjusting for risk and the discount rate

- Sensitivity analysis

- Scenario analysis

- Probability analysis and problems associated with using probability analysis

- The risk of insolvency

portfolio theory

- Holding period returns

- Combination of investments

- Portfolio expected returns and standard deviation

- Indifference curves

- Selecting the optimal portfolio

- Boundaries of diversification

- Capital market line

capital asset pricing model and multi-factor model

- Shares, bonds and bills

- Capital asset pricing model

- Factor models

- Arbitrage pricing theory

- The three-0factor model

- Project appraisal and systematic risk

sources of finance

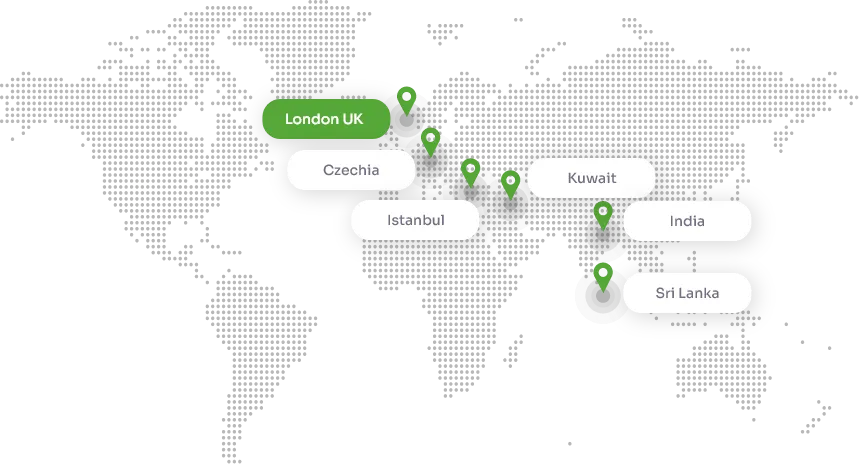

- Stock exchanges around the world

- Globalisation of financial flows

- Equity markets available to companies

- Taxation and corporate finance

- Equity capital

- Reference shares and methods of issue of shares

- Rights issue

- Debt finance. Bonds, bank borrowing, syndicated loans

- Credit rating

- International sources of debt finance

- Project finance

- Short and medium-term bank finance

- Trade credit

- Factoring

- Hire purchase and leasing

- Bills of exchange

- Risk management

- Working capital management

corporate value

- Three steps of value

- Earnings-based management

- How a business creates value

- Strategic business unit management

- Using cash floe to measure value

- Shareholder value analysis

- The cost of equity capital

- Cost of retained earnings

- Cost of debt capital

- Cost of preference share capital

- Valuation of shares

- Vlue and effect of gearing

- The capital structure decision

managing risk

- Forward rate agreements

- Futures

- Caps and swaps

- Derivatives users

- Effects of exchange rate changes

- Types of foreign exchange risk

- Transaction risk strategies

- Managing economic risk

- Exchange rate determination

learning outcomes for the unit

Upon successful completion of the course students will be able to:

- Demonstrate a critical awareness of the functions and decision-making areas associated with corporate financial management

- Provide clear justifications for the selection of appropriate financial strategies and policies for a company;

- Use quantitative models to analyse financial decisions and recommend appropriate courses of action that companies can implement;

- Complete a systematic and detailed analysis of a company’s performance using financial information and financial records

- Demonstrate an understanding of the appropriate analytical techniques relevant to decisions involving the raising of finance

- Provide clear recommendations on the use of funds for investment projects

learning and teaching methods/strategies used to enable the achievement of learning outcomes:

Learning takes place on a number of levels through lectures, class discussion including problem review and analysis. Formal lectures provide a foundation of information on which the student builds through directed learning and self-managed learning outside of the class. The students are actively encouraged to form study groups to discuss course

assessment methods which enable student to demonstrate achieving the learning outcomes for the unit:

Project (5000 words) on a topic selected by the candidates which addresses the learning outcomes of the unit

indicative reading for this unit

main text

Arnold, G. (2013). Corporate Financial Management, 5th edn. Harlow: Financial Times/Pitman Publishing

alternative text and further reading

- Berk, J. and DeMarzo, P. (2013). Corporate Finance, 3rd Edition. Boston, Mass: Pearson/Addison Wesley.

- Brealey, R. A., Myers, S. C. and Allen, F. (2013). Principles of Corporate Finance, 10th Edition. London: McGraw Hill.

- Pike, R. and Neale, B. Linsley, P. (2013). Corporate Finance and Investment, 8th Edition. London: Prentice Hall.

- Watson, D. & Head, A. (2013). Corporate Finance: Principle and Practice, 6th Edition. London: Prentice Hall & Financial Times.

guideline for teaching and learning time

(10 HOURS PER CREDIT)

100 hours - lectures / seminars / tutorials / workshops:

Tutorial support includes feedback on assignments and may vary by college according to local needs and wishes.

100 hours - directed learning:

Advance reading and preparation / Class preparation / Background reading / Group study / Portfolio / Diary etc

100 hours - self managed learning:

Working through the course text and completing assignments as required will take up the bulk of the learning time. In addition students are expected to engage with the tutor and other students and to undertake further reading using the web and/or libraries.